"What Gets Planned and Measured Gets Done" Comments on the state of affairs in business, organizations, academics, process improvement, quality, education, government, etc...

Saturday, October 28, 2006

Business Schools and Instructors need a Transformation – NOW

Now look at these companies today, a poor shell of what they were in the so-called Glory Days. One main cause that is found in all of these companies has been poor management. So from a Quality perspective what is the input or place that produces poor managers in such abundance? One might say poor managers learn their skills on the job, which is true in many cases. However, the University and Colleges in the United States needs a major transformation in the way they are producing our industry leaders and managers.

Why is it that so many leaders are short sighted in planning and strategy and think the only way to manage are by result measures and bottom line finances? Is it because that is what they learn in most of the business texts and then the professor or instructor teaching the class reinforces the information?

I taught Management and Business in a University and I have many of the textbooks. I sat in many of classes where the instructor would not allow difference of opinions on how to manage and lead that contradicted the text or their research. In other words they did not want to hear from the workers or low to middle range managers that took the brunt of poor manager decisions.

I can still remember studying with a Japanese Graduate Student in 1981 when we both took the same management class. He was from Kyoto and was in the United States studying Hotel Management. He told me how disgruntled he was because the perception he had prior to coming to the United States was that he would return home with knowledge that would land him an excellent job.

What he was learning was to concentrate on the bottom line and make sure your finances were in order and get the best Chief Financial officer you could find. There was no mention of customers except that is who bought your services. Employees were workers who got paid to do a job and long term planning was a no no and thought “Systems Thinking” was something from the IT Department

Has anything changed?

Yes, two of the companies are fighting for their survival; one died and was brought back to life in name only (R.I.P. Ma Bell).

Updated 10/28/06

M.B.A.s: The Biggest CheatersMarketWatch By Thomas Kostigen Graduate business students take their cue from corporate scandals .

Article at http://biz.yahoo.com/weekend/mbacheat_1.html

Tuesday, October 24, 2006

Quality "FOOLS" --> "Enron's skilling going to the slammer- sentenced to 24 years" updated 10/24/06 - See # 25

The following examples further prove the demise of American Management and proof that many Executives are out of control.

So - What Kinda Fool Do you Think I Am?

1) Fed exec says age to retire needs to rise - http://www.freep.com/money/business/tompor11e_20050511.htm

Michael Thompson http://www.freep.com/index/thompson.htm

qg says...

Mr. Gramlich is 65 years old, would he want to do this if he was 45 years old? Why doesn't he consider the thousands of workers who are struggling to make it to retirement now, many are in jeopardy of losing their jobs and those who are hanging on are piling up sick days do to stress related illnesses. I guess we just let health care prices rise along with the SS age.

1a) Gramlich to leave Fed, return to teach at U-M

May 19, 2005

2) United Gets OK to Dump Four Pension Plans

http://hosted.ap.org/dynamic/stories/U/UNITED_AIRLINES?SITE=MIDTF&SECTION=HOME&TEMPLATE=DEFAULT

qg says...

United Airlines' plan to terminate employees pension plans. The government's Pension Benefit Guaranty Corp. (PBGC) will assume the employees' fund. qualityg Domas predicts... this will cause a trickle horizontal effect across the airline industry. When I keep reading company after company downsizing people out the door and stealing pension money I just think of the Tracy Chapman song "Revolution." I would now add "Middle Class People"

Poor people gonna rise up

And get their share

Poor people gonna rise up

And take what's theirs

Finally the tables are starting to turn

Talkin' bout a revolution

updated 7/20/05

2b) NWA freezes pensions of 3,300

"Now that it's freezing the pensions of salaried workers, the airline hopes to have an easier time convincing unionized workers to go along with such a move. For those workers, it's a matter to be settled at the bargaining table."

qg says... NWA motto towards employees should be "Heads I Win, Tails You Lose."

updated 6/14/05

2 c) When Pensions Collapse

http://biz.yahoo.com/special/pension05.html

updated 8/19/05

3) SBC-AT&T - Bye Bye Miss American Pie...

NEW YORK - Top executives of AT&T Corp. would receive $31 million in severance pay if the long-distance company's deal to be acquired by SBC Communications Inc. goes through as planned.

JEFFREY BROWN: Professor Katz, I want to ask you about AT&T because probably for most people here the big story is the demise of AT&T. Why in the end was it unable to survive?

JAMES KATZ: I think a large element is the fact that it wasn't able to get back into local service. Although it once was America's largest private employer back before the divestiture of 1984, it (qg says... -NOT IT, --> LEADERSHIP OWNS THE SYSTEM, THAT'S WHAT DID IT) has made a series of business blunders that have cost billions. It got out of the wireless mobile phone business, got back in, got back out, and has essentially just had a heritage of great mistakes.

The company would have paid an additional $10.3 million to chairman and chief executive David Dorman if he was not slated to become president of SBC after the merger, according to a filing late Friday with the Securities and Exchange Commission.

The filing also detailed millions of dollars worth of stock options, restricted shares and performance-based shares which will vest earlier than originally intended as a result of the merger. However, the executives also will forfeit some performance shares as a result of the merger.

Dorman will receive early access to $17.7 million worth of options and shares which he would have received over the next several years, based on the $19.71 value assigned to AT&T's shares in the SBC merger agreement. But Dorman also will forfeit $7 million worth of performance-based stock, company spokesman Andrew Backover said.

AT&T President William Hannigan stands to receive the largest cash severance, nearly $6.5 million. He also would receive early access to restricted and performance-based shares worth nearly $10 million based on the deal price, but would forfeit $4.5 million in performance stock.

The other big severance payments include $4.7 million for Thomas Horton, the chief financial officer; $3.8 million for James Cicconi, the general counsel; and $4 million for Hossein Eslambolchi, the chief technology officer. Other executive officers would received a combined $12 million in severance payments.

JCR stated... " Michael Moore (he can be a Fool Too) should do a documentary " AT&T the Demise of an American Icon."

updated 5/12/05

4) "Just rename the city of Detroit to New Fallujah, Michigan"

Nationally syndicated radio host Rush Limbaugh said that a November 19 brawl that broke out during a National Basketball Association (NBA) game was "hip-hop culture on parade." Limbaugh asserted that the fight -- which involved Indiana Pacers team members and Detroit Pistons team members and fans -- was "gang behavior on parade minus the guns," and that NBA uniforms are "now in gang colors. They are in gang styles." In making the comments, Limbaugh conceded that his remarks were likely to be "tagged as racist." Limbaugh also appeared to compare the brawl to the unrest in Fallujah, Iraq, suggesting that Detroit be renamed "New Fallujah, Michigan."

david letterman - "Iraq minus Saddam Hussein equals Detroit." sorry the Pistons keep beating (up) the pacers daaavey! Geez daveeey, how come your such a jerk, Sally is from Detroit.

qualityg says...

4a) see my post on Absolute Power and the the bully! Absolute Power - Bully

4b) rush limbaugh is a big punk! and should become more humble http://en.wikipedia.org/wiki/Rush_Limbaugh#Controversies

4c) note to self, rush is just an entertainer (i.e. al franken, david letterman) doing his job, he's a big joke

5) Tracing Collins & Aikmans spiral toward bankruptcy

http://www.freep.com/money/autonews/collins18e_20050518.htm

C&A, according to former executives, supplier rivals and Wall Street analysts who track auto suppliers, was also guilty of "buying business" from the automakers. That means it bid on contracts at prices where it couldn't make a profit.

"They built up a backlog of business that they bought and then they realized they couldn't make money at it, so they started cutting costs and jobs, and that created operational issues with customers," Jeff Skoglund, high-yield auto analyst for UBS Inc. in New York, said Tuesday.

qg says... disgusting

6) I called Michigan Senator Carl Levin's Detroit Office Monday to ask a question about the high rate of unemployment (6.9, second behind Mississippi). Is there anything on the Senator's Federal agenda to help the folks in Michigan who are still losing jobs as I write (see previous post # 5) with extended unemployment benefits?

updated 7/26/05 - Michigan has surpassed Mississippi and is now Number 1.

Response - Go "bug" the Republicans, it's their fault, they keep denying the Benefits.

qg says... Thank You Mr. Levin's Rep- see you at the voting booth!

qg says... Received an Email response from Senator Debbie Stabenow, not what I wanted to hear but she was kind enough to respond. Thank you Senator.

6a) Jobless rate in Michigan rises to 7%

May 19, 2005

BY GRETA GUESTFREE PRESS BUSINESS WRITER

Michigan's unemployment rate still ranks as one of the highest in the nation with a rise to 7% in April, despite new job growth.

qg says... My hope is Steven Levitt does a piece on the "true" unemployment figures in his next article or book.

updated 5/24/05

7) EX-HEWLETT-PACKARD CEO SPEAKS: Fiorina: No job entitlement

Asians, others deserve work just as Americans do

Carly Fiorina ex CEO Hewlett Packard and ex President of AT&T North American Network Systems said that no one, not even her is entitled to a job. This and other comments were made at the Detroit Economic Club on Monday 5/23/05.

Fiorina isn't sure what she is going to do next, perhaps write a book or go into public office. She can take her time since she received at least 21.1 million dollars in a severance package. That does not include the monies she also received when she left her President's job at Lucent in 1999.

qualityg says...

Carly! What kind of fool (do you think I am?) Oh yea, What kind of fool (do you think I am?) one more time now --> What kind of fool (do you think I am?)

I'm sick and tired of CEOs like you "assuming" they know American Workers values and want to shift the burden of proof as to why there is so much unemployement on to their backs. I'm sorry but I don't have any friends who expect something for nothing, nor have I worked with anyone who felt any different.

It's common place today for Politicians and Business leaders to use lack of math and science skills to say we are falling further behind the Asians. Were not falling further behind in talent, maybe numbers (lets see a billion Chinese, a billion Indians) but not talent. There are thousands of engineers, scientist and math majors looking for jobs in the United States.

The problem is today's leaders do not want to pay the standard of living in the United States. The same standards by which they want to be paid.

Americans can compete now, and in the future. What we need are more creative and innovative minds to start new industries and invent new products that can be made in the United States. I am not for isolation and I favor global competition, I just feel you should dance wth the ones who brought you, not the cheapest looking whore outside the door.

updated 7/20/05

7a) Hewlett-Packard to Cut 14,500 Jobs

The cuts -- about 10 percent of its global work force of 150,000 -- will occur over the next six quarters. Most will affect support jobs such as information technology, human resources and finance.

"Our objective is to create a simpler, nimbler HP with ... clear accountability and greater financial flexibility," said HP CEO Mark Hurd on Tuesday.

qg says...

"Mark be Nimble, Mark be Quick, Hope you know it's not the people, it's Management -> SLICK!"

qualityg(domas) says... next group to get contracted (more than even now) out and sent overseas will be the Human Resource Department. Many senior officers in the United States have always labeled the HR Department the "dumping ground." They give much 'Lip" service about how important our employees are and how we need to make sure they are proud to work for our corporation and give them the training and tools that will enable them to do a good job. We all know that Training Budget gets cut first, and that is why most work groups try to get training done in the first quarter of the year before the budget gets changed. The only time a company is "truly" committed to Training is when it shows up on the budget report as an Asset and not an Expense (what does yours show).

We need a concentrated effort to avoid CEOs and their companies that want to exclude American workers from the playing field.

That's right America, keep watching reality shows like the "Apprentice" to see how companies should be run by the next generation of young guns who will sell their soul for some exposure, do you think they would not sell yours if the dollars were offered. I sure hope there still not teaching this type of leadership crap in the MBA programs.

updated 9/24/06

7b) - HP Chairwoman Dunn Resigns

Ex-HP Chairwoman patricia dunn told HP investigators to spy into the personal lives of seven directors, nine journalists, two employees and family members of those targeted individuals.

patty hired investigators who impersonated board members, employees and journalists to obtain their phone records. The detectives also spied on an HP director and created an e-mail sting to fake a reporter for CNet Networks Inc.'s News.com, an online technology site.

qualityg says ... patty cake, patty cake, bakers man, spy on my people and get cooked in a frying pan.

Guess who is taking over for patty? See 7a - it's mark be nimble mark be quick, mark takes over for another HP woman, oh that mark is slick!

7c) - fired CEO carly speaks out about her new book "tough choices"

"When I finally reached the top, after striving my entire career to be judged by results and accomplishments, the coverage of my gender, my appearance, and the perceptions of my personality would vastly outweigh anything else. It disappoints me greatly. "

qualityg says ... How about on your way to reach the top did any of those qualities you see as negatives help you gain positions?

Your next position should be in politics - you already have down pat the ditinguished quality of blaming everyone else except yourself. Tough Choices? - No Tough Luck!

updated 6/6/05

8) - Putin, Putin, Putin what's that BS you're a tootin??? - Democracy in Russia

Aleksander Solzhenitsyn says..."If they are going to take away our democracy, they can take away only what we have. But if we have nothing, then nothing can be taken away."

qualityg says... now that's "Systems Thinking."

qg also says... "Manage their own destinies." When I read this I thought of the Noel Tichy and Jack Welch book - "Control Your Own Destiny or Someone Else Will." Anyone who "truly" knows the history of GE's early days. (In the early 1980s he was dubbed "Neutron Jack" (in reference to the neutron bomb). The chapter "the neutron years" in his book says that GE had 411,000 employees at the end of 1980, and 299,000 at the end of 1985. Of the 112,000 that left the payroll, 37,000 were in sold businesses, and 81,000 were reduced in continuing businesses).

When other companies were implementing TQM, GE was removing employees (how come GE didn't use Six Sigma). What Quality folks (especially fly by night consultants) won't admit is in the early 80s to mid 90s many of the leading Quality companies had already removed "low hanging fruit" and identified which processes needed to be fixed. Once you do that you are left with very complex fixes to correct and stabilize processes that were neglected for years.

When GE started the Six Sigma rush in the mid 90s they were removing "low hanging fruit," which gave the perception that the other companies quality efforts were all wrong. Now in the mid 2000s go to any of the major Six Sigma related chat rooms and tell me if you are hearing anything different as to why it won't work (i.e., leadership won't support, not producing fast enough results, costs to much to train everyone, mid management feels threatened, and of course teams don't have time to meet because of their "regular" jobs, Blah, Blah Blah!

Very wise words "control your own destiny." You have to go out and find your destiny, search for what it is in life you wish to accomplish and go after it. No one is going to knock on your door and tell you it's waiting for you on the front lawn.

Example, when you lose your job, no one is going to call you and say "please come work for me." You have to get off your butt and make it happen, that is destiny. If you don't then you can go on welfare and let the Government control your destiny.

updated 6/8/05

9) - GM plans to close more U.S. factories

Bob Seger and The Silver Bullet Band’s song “Like A Rock” used to be the theme song for Chevy Trucks. I think it should now be Big Bob’s “Feel Like A Number”

And I feel like a number

Feel like a number

Feel like a stranger

A stranger in this land

I feel like a number

I'm not a number

I'm not a number

Dammit I'm a man

I said I'm a man

The struggling automaker will eliminate an additional 25,000 U.S. hourly jobs, or about one in five, between now and the end of 2008, despite already eliminating 22,000 U.S. hourly jobs over the previous four years.

I hope all you non-GM employee stockholders are happy that GMs stock finally rose 38 cents yesterday on the news of the auto plants closing and the downsizing of 25,000 jobs. You see once the stock gets up a few dollars the stockholders are going to cut their losses and GM will be right back where they are today. So what will they do? All together now, cut some more, like a dimestore whore. Beware of K.K. because he will have his share.

Now GM you are a fool if you think this will help, Oh sure in the short-term, what I’m talking about is a plan of action for both the ST and long-term. This will require ingenuity and creativity. This type of planning is hard work, it requires working side by side with your suppliers and your customers (internal & external), it requires leaving your bean counters at home, better yet get rid of them, what do they produce, what value do they bring your company? Who the Hell does your forecasting? Here is an idea --bring back Dr. Ron Moen.

I remember a time when companies like General Motors and AT&T used to lead the way in leadership and management techniques. Now they are followers, in AT&T’s case they are just a plain loser. Management owns the system, get rid of them (see how easy it is to say, even easier to do).

The "willing worker" loses again (so does the economy, your neighborhood, your tax base, your joy of work and your self-esteem), the Union leadership is a joke, they can’t anticipate anything except the summer picnic and they don’t have the faith or trust of the rank and file no matter how hard they want to believe that they do.

From the album “Night Moves”

The wind came building from the cold northwest

And soon the waves began to crest

Crashing cross the forward deck

All hands lost

I alone survived the sinking

I alone possessed the tools

On that ship of fools

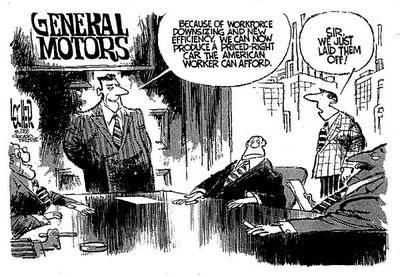

by Dick Locher/Chicago Tribune

updated 6/29/05

GM is projecting that by 2008 its entire American workforce will be about the size of what its workforce once was in Flint Michigan Alone.

10) General Motors and Quality?

The press and the stock raters (short term thinking slugs) have been recently slamming General Motors. The one group that concerns me the most is the suppliers of GM. For years GMC as been punishing their suppliers for increasing their profit margins and ultimately threatening to go to a cheaper supplier.

I think I wrote this in 1983. “One of the things that differentiates the Japanese and other Asian car manufactures with those of GMC is that they have respect for the individual and look at them as partners. They work in each other’s plants and are members on the same quality teams as equals.”

For the last few weeks GM has been taking out full-page ads that state “GM. The Initials to know in initial Quality.” Then eight J.D. Power Quality Award statues are shown.

There seems to be a conflict here, Suppliers and UAW should be part of the process team that provides the inputs and productivity so that GM can win the Quality Awards. Why is it then the majority of suppliers rate Toyota and Honda as preferred customers and GM NOT?

OK, let’s go back to Process 101 (bring API - Associates For Process Improvement -http://www.apiweb.org/API_home_page.htm ); the flow shown below is a very high-level end-to-end SIPOC Flow. Now a company that has numerous ISO 9000 certifications and J.D. powers awards should display some honest and trust with their supplier partners.

updated 7/12/05

10a) - UAW hires a team of experts to examine the finances of GM

Union President Ron Gettelfinger says "We're looking at everything, The process right now is we've got our in-house experts. We've brought in some people (outside consultants) to assist them, and we're right now doing an analysis of the financial standing of the corporation. We're also looking long-term."

qg says... and we are "now" doing an analysis! Please don't tell me RG you are still inspectiong quality in at the "end" of the line. Of course you're not, so why do you think you need to inspect financials "after" the fact (I bet the consultants sold you on this one). Cmon, figure out what you need to do, if you can't, send me an Email and I'll let you know for free.

Updated 7/26/05

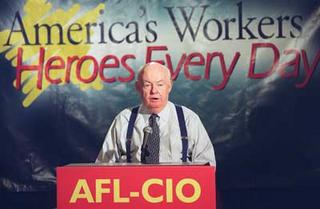

10b) - SHUT EM BOTH DOWN!

MAJOR FOOLS (AFL-CIO Leadership) RUSH IN TO

GET THE BEST SEATS IN THE HOUSE

Last week I posted about the UAW, this week it’s the AFL-CIO. What a bunch of reactive after the fact morons (Leadership). You can’t say qualityg just picks on traditional CEO type leaders.

I grew up in a Union Household. My Dad belonged to the Teamsters and worked for one of the major Newspapers in Detroit. Teaching Labor Relations years ago I am familiar with the history of the Union and the importance they had in shaping the standard of living we have today, or should I say losing the standard of living we have today. And, you know what? The Union Leadership is just as responsible for that too.

I can remember the Detroit Newspaper strikes of the late 60s and early 70s that caused some really tough years. I still won’t eat lima beans and I just started liking peanut butter again. I went with my Dad as a teenager to Union Meetings and saw well-run and very militaristic type of structure (perhaps because many of the men were WWII vets) and plans when dealing with Management during a strike. Companies feared the Union, but today they no longer do. Why? Because the Union used to “SHUT EM DOWN.” Wanna mess with our jobs and families, then we’ll shut you down.

There (again) in todays paper a picture of Jimmy Hoffa. In the early to mid 70s I used to have lunch at the “Machus Red Fox” where Jimmy was last seen. Today, Jimmy’s son runs the Teamsters and he and Andrew Stern president of the Service Employees International Union are breaking away from John Sweeney and his leadership weenies.

The sweeney weenies kiss the feet and pay for political clout by backing bone head (not all) Democrats that promise to support them once they obtain office. You see meenie weenie sweeney; the corporate leaders of today do what they want, when they want and how much they want because they are no longer afraid of the Unions. Especially a bunch of old guys sitting around in a Union Hall convincing them selves that what they do matters.

When I worked for the Communications Workers of America (CWA) in the late 70s and was promoted to management in the early 80s I was involved in two strikes, one as Union and one as Management. It was at that time I knew the Union was in trouble. The CWA bargaining team and leadership were a bunch of sissies compared to the war room talks that I was privy to 10 years prior.

Union Leadership has been in a reactive mode since the 80s (i.e., no support for union members from other unions or leadership during the long Detroit Paper strike of the 80s, that cost thousands of members their jobs, homes and families) and have lost the faith of their membership and lower level management people who often sided with the union in hiding. After all, what the Union got, Management got and the standard of living increased.

Today, it’s just the opposite, mid and lower management are the first sheep to lose their pensions, benefits and jobs, then senior leadership uses that as a leverage for non-management and union workers. I say foe each 100 jobs lost, I Union Leader from that group must be fired and lose his/her job as well. The Union Leadership no longer feels the pain, there benefits are secure, and their pensions will be OK. Get rid of them and WAKE UP! Rank & File!!

“RANK & FILE ---> SHUT EM DOWN” – that was the battle cry of the first 70 years of the 20th century, it should be the same for the 21st century

Be a Voice, Not an Echo

Honesty & Trust are the critical values one has in the predictability that an individual or group will do what they have agreed to do. Once a company or union leadership has developed a degree of stability, reliability and integrity with their suppliers,workers and customers, they can be objectively and respectfully measured and observed.

updated 7/5/05

Below is a blog post by Jay Fitzgerald who has been a journalist and blogger for years. He's now the general economics reporter for the Boston Herald.

Reader G below (actually qualityg) sent this response to Mr. JF about GM. I responsed to 'GM Death Watch,' Part III which stated "Ah ha! Now J.D. Power is reconfirming my prior argument that American automakers are making better cars than they're getting credit for. Glad to see my personal favorite -- the Chevy Malibu -- made the list.

'GM Death Watch,' Part IV

Reader G writes "Sorry, what JD Powers says is nice, but they don't represent the true customer. I'm pulling for GM, but their Leadership is taking them down the tubes. They have forgotten/ignored everything Dr. Deming taught them in the 80s and early 90s."

I believe he's talking about this gentleman. I can't and won't deny GM has management problems. But I do think many of its cars suffer from overly unfair and snobbish criticism.

Posted By : Jay Fitzgerald

qualityg says... I agree with Mr. JF that some GM cars may be overly criticized. However, JD Powers measures their quality and reliability awards over the 1st 90 days & over a three-year period. qg loves good reliable measures based on quality and customer satisfaction, I just feel 90 days is not a good results measure. In my opinion it is a process measure that should provide a data point on a trend chart that continues to measure for what the customer expects to be the life-cycle of the vehicle. For a lease car, a three-year period may be sufficient, but for a long-term car owner I would think a seven-year time period would be a better results measure.

UPDATED 11/22/05'GM Death Watch' Part V

GENERAL MISERY: Automaker’s plan to cut 60, 000 workers

Big GM job cuts put the Grinch into the holidays

GM said it would stop production at 12 plants and cut 30,000 hourly jobs in North America by the end of 2008. Another 2,500 salaried jobs at GM are in the crosshairs.

Update 6/27/06

'GM Death Watch' Part VI

General Misery (GM) is at it again, this time the local papers (Detroit Free Press & Detroit News are loaded with articles, comments and figures. If you look at the previous posts you will see I have been updating GMs plight for over a year.

http://www.freep.com/apps/pbcs.dll/article?AID=2006606270305

http://www.detnews.com/apps/pbcs.dll/article?AID=/20060627/AUTO01/606270365

I am not going to provide much comment about this latest round BS on how all these cuts and changes are going to help.

However, since this blog is about quality I must share this question and answer from the Detroit Free Press

QUESTION: Will this hurt General Motors or Delphi quality?

ANSWER: GM and Delphi say that quality will not be affected. But the job cuts will create some worker shortages this year at dozens of plants across North America. Both companies plan to hire temporary workers to ease the transition, and some observers say quality could be hurt.

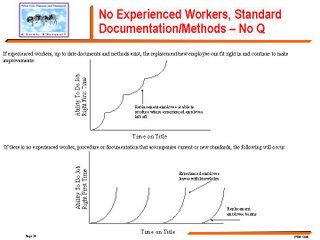

qualityg says ... I wrote about some of the impacts of losing experienced workers in a post this past week http://qualityg.blogspot.com/2006/06/another-example-of-demise-of-american.html

Below is a graph that will help explain why this is statement is so wrong and just plain stupid on the part of GM and Delphi and any other company that wants to "lie" about losing experienced workers.

CLICK ON PICS TO ENLARGE

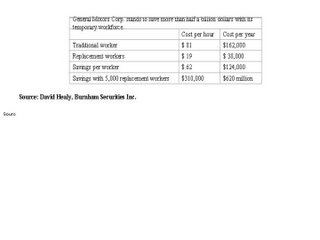

The table below provides data on the savings GM expects to get on labor. The only problem is they are looking at these figures like they do for many of their reports. It is vague, does not include all of the inputs to make that decision and is void of any type of Systems Thinking (i.e., It is Independent of itself, it should be Interdependent and take into account more factors, like the ones shown in my graph above). Where is the cost of poor quality that will be inherent with all of the "new" employees? Click pic for better view.

GM Death Watch Part VII (7/19/06)

GM Death Watch Part VII (7/19/06) While listening to the news this morning I heard that General Motors Corp. Chief Executive Officer Rick Wagoner said Tuesday at the British International Motor Show that he has "no intention of leaving my position at GM" and that second-quarter earnings will show the company's turnaround plan is working.

I'm glad Mr. Wagoner is fighting back my only fear is that trying to turnaround a company the size of GM is like trying to turn a battleship on a dime.

I'm glad Mr. Wagoner is fighting back my only fear is that trying to turnaround a company the size of GM is like trying to turn a battleship on a dime.

GM, Ford, & Chrysler,

Oh yeah, love the new GM commercial and ads, "now everyone can enjoy the same discount as GM employees get at the dealer." For years you have enticed and tried to fool the public with advertising slogans showing the GM discount amounts just to get people into dealership. Hate to tell all you auto sales and marketing execs that we know what you are doing, so please just tell us how much the stinking car costs!

updated 7/20/05

10c) VW exec issues a warning

"I expect everyone to be clear about what situation we are in and what a crossroads we are standing at," Wolfgang Bernhard said when asked what he expects from employees. "And I expect everyone to play a part and be ready to tread new paths."

qg says... sure is a bunch of "I"s in that statement. Well Wolfy, you can no more expect your people to respond and correct the situation anymore than when I yell out at the tree I planted last spring to grow. "I expect you to grow, I expect you to be fruitful and bug free, Dammit!"

C'mon, WB --> give a "method" to your madness, provide a blueprint and a roadmap to improve, nurture your employees by giving them the tools, pride and respect they deserve. You do that and I'll take care of my tree by making sure it gets the correct amount of food, water and nurturing and I bet we both will be alright by the Fall.

Oh yea, one more quote from WB --> "Wolfgang Bernhard was vague about whether jobs might be cut."

updated 6/18/05

11) Tyco Execs Guilty of Fraud, Larceny & Acting like Fools at the Toga Party

Former Tyco CEO L. dennis kozlowski leaves court in New York Friday. kozlowski and a second former executive were convicted of looting the industrial products and services company Tyco International Ltd. of more than $600 million in corporate bonuses and loans.

kozlowski, 58, and swartz, 44 were convicted of grand larceny, falsifying business records, securities fraud and other charges. Both used Tyco's money to buy extravagant lifestyles that featured art, jewelry and real estate, prosecutors said. An example of that spending was the gaudy $2 million toga party kozlowski threw for wife Karen's 40th birthday on the Mediterranean island of Sardinia, they said. Tyco paid about half of the party's cost.

updated 9/21/05

Former Tyco execs get 25 years

Kozlowski and Swartz sentenced

Former Tyco CEO L. Dennis Kozlowski was sentenced Monday to up to 25 years in prison for looting the company of hundreds of millions of dollars, the climax of a case of executive greed replete with tales of a $6,000 gold-threaded shower curtain and a $2-million Mediterranean birthday party.

Tyco's former finance chief Mark Swartz, 44, received the same sentence, and state Supreme Court Justice Michael Obus ordered the defendants to pay a total of $134 million in restitution to Tyco International Ltd. Additionally, the judge fined Kozlowski $70 million, and Swartz $35 million.

Kozlowski and Swartz will be sent to one of New York's prisons because they were convicted in state court, meaning the former executives will do considerably harder time than they would have at a federal facility.

qg says... Koz & Marky, bring your own soap!

updated 10/05/05

No bail for ex-Tyco execs while they appeal convictions

A judge yesterday refused to release former Tyco International executives L. Dennis Kozlowski and Mark Swartz on bail while they appeal their convictions on charges of stealing some $600 million from the company.

Lawyers for the two -- Austin Campriello for Kozlowski and Charles Stillman for Swartz -- applied for bail the day after the sentencing by State Supreme Court Justice Michael Obus. Assistant District Attorney Marc Scholl argued against the application.

Stillman said he was "terribly disappointed about the decision to deprive Mark of his liberty while he pursues his appeals."

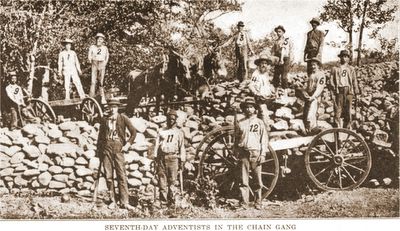

Hey, Is that the sound of the boys working on the Chain Gang?

The following survey was copied from the Yahoo Finance Page http://http://finance.yahoo.com/

What percentage of the estimated 1,300 executives that have recently been charged with fraud have pleaded guilty or been convicted of a crime?

A -13%

B -33%

C -43%

D -53%

Correct answer is "D"

Even though former HealthSouth (HLSH.PK) CEO Richard Scrushy was recently acquitted of 36 counts of fraud, prosecutors have a pretty good track record when it comes to gaining convictions against business executives.

According to a Justice Department spokesperson, over 693 executives have recently been convicted of fraud or plead guilty including high ranking officials at Tyco, WorldCom and Adelphia.

Healthsouth Corp. -- Former CEO richard scrushy could spend the rest of his life in prison if convicted on all 36 counts of conspiracy, false reporting, fraud and money laundering for allegedly orchestrating a $2.7 billion earnings overstatement at the rehabilitation and medical services chain for seven years beginning in 1996.

Worldcom Inc. -- bernard ebbers, former chief of the one-time telecom giant, was found guilty of fraud, conspiracy and making false regulatory filings in WorldCom's $11 billion accounting scandal.

Enron Corp. -- Enron founder kenneth lay, former CEO jeffrey skilling and former top accountant richard causey are scheduled to go to trial in January on federal fraud and conspiracy charges.

12/27/05 - Enron's former accounting chief, richard "I want my Mommy" causey, has agreed to plead guilty and testify against his former bosses in exchange for a chance at a lighter prison sentence. causey had been scheduled to go on trial next month for conspiracy and fraud alongside the bankrupt energy-trading company's former chairman, kenneth lay, and chief executive, jeffrey skilling. "This is not what skilling and lay were hoping for on the eve of the trial," said one legal expert. A lawyer for skilling said the defense would have to "substantially regroup."

12/29/05 - Prosecutors with the Enron Task Force scored a coup Friday when ken rice, former CEO of the company's broadband unit, pleaded guilty to one count of securities fraud and agreed to cooperate with their investigation. The guilty plea, which carries a maximum sentence of 10 years, gives prosecutors a significant witness against jeff silling, Enron's former chief executive officer.

Adelphia Communications Corp. -- Founder john rigas and his son timothy were convicted in federal court last year of conspiracy, bank fraud and securities fraud. The two are to be sentenced Monday.

Credit Suisse First Boston -- The company's former investment banking star, frank quattrone, was convicted in May 2004 on federal charges of obstruction of justice, after his first trial ended in a hung jury. quattrone, who made a fortune taking Internet companies public during the dot-com stock boom, was sentenced to 18 months in prison. He is free on bail and appealing the conviction.

updated 6/21/05

12) Adelphia Communications Corp.

Founder John Rigas was sentenced Monday to 15 years in prison by a judge who blamed him for defrauding investors of his bankrupted cable company in one of the largest frauds in corporate history.

qualityg says... NEXT!

updated 6/29/05

13) HealthSouth's Scrushy acquitted of all fraud charges

richard scrushy "slithered" out of the fraud trial but he will lose his fortune in the civil trial. Alas, dickster, you can at least still have your religious show, will you be dancing with one of those rattlers?

"Scrushy is accused of conspiracy, fraud, money laundering, obstruction of justice and perjury. He also is charged with false corporate reporting in the first test of the 2002 Sarbanes-Oxley Act against a chief executive.If convicted, Scrushy could get what amounts to a life sentence and be ordered to forfeit as much as $278 million in cars, boats, homes and other assets."

The scandal devastated HealthSouth, which teetered on the edge of bankruptcy for months despite once having more than 50,000 employees at 1,900 locations in all 50 states. Its stock traded around $30 a share before it was delisted from the NYSE and is now worth around $6.

Layoffs and closings at the company have reduced employment to about 41,000 people at 1,380 sites.

Updated 12/16/05

13a) Scrushy the snake Sues HealthSouth for $70M

Sushi is suing the company he founded, seeking more than $70 million for what he says was a breach of contract resulting from his March 2003 firing.

snake scrushy claims in the suit filed Wednesday that his employment agreement with HealthSouth should remain in force given his June acquittal on 36 criminal counts related to the fraud.

According to the state court lawsuit, snakes 2002 contract calls for at least $1.2 million per year in salary for his role as chairman and director, at least $1.2 million per year in bonuses, a portion of bonuses or incentive plans other top executives at HealthSouth were entitled to, stock options, employee benefits and various fringe benefits and severance pay.

Updated 12/31/05

13b) Sweet Sweet Home Alabama - Did you know the state snake is named "Scrushy?" It's a slimy creature that slithers in and does its damage by spewing its venom. Then it slithers away to let others face a slow death while he rests in the sun.

I still can't believe fifteen former executives pleaded guilty, including all five of the no-backbone finance chiefs who reported to scrushy during his tenure and yet he remains free acting with his wife like Jim & Tammy Bakker.

Updated 7/12/05

14a) WorldCom's --> bernie ebbers loses his wealth! - NOT good enough

In a civil suit settlement bernie (my favorite ex-ceo) will forfeit nearly all his cash and personal assests that comes to around $45 million. The sentencing is next. bernie asked the judge for leniency, citing charitable work and heart trouble.

update - 7/13/05

WorldCom's ebbers Gets 25 Years in Prison

bernie ebbers, who as CEO of WorldCom oversaw the largest corporate fraud in U.S. history, was sentenced Wednesday to 25 years in prison.

The sentence was handed down by Judge Barbara Jones of U.S. District Court in Manhattan three years after WorldCom collapsed in an $11 billion accounting fraud, wiping out billions of investor dollars.

update 8/05/05

14b) Ex-WorldCom Accounting Executive betty vinson Is Sentenced to Five Months in Prison, House Arrest

Former WorldCom accounting executive betty vinson was sentenced Friday to five months in prison and five months of house arrest for taking part in the telecommunications company's record $11 billion accounting fraud.

qg says... I like equal opportunity sentencing.

updated 8/9/05

14c) Ex-WorldCom Accounting Director Buford Yates Is Sentenced to One Year and One Day in Prison

"There is not a day that goes by that I don't think back to my actions and regret my decisions," Yates told U.S. District Judge Barbara Jones. "I chose the easy way out."

qg says... see ya later "BuD"

updated 8/11/05

14d) Ex-WorldCom CFO "scotty sullivan" Gets 5 Years in Prison for Role in Fraud; Judge Calls Him 'Architect' of Scheme

Former WorldCom finance chief Scott Sullivan, who carried out the largest accounting fraud in U.S. history but insisted he did it under pressure from his boss, was sentenced to five years in prison Thursday by a judge who called him "the architect" of the scheme.

The judge said she was giving Sullivan a break because his wife has diabetes and during her frequent hospitalizations has been unable to care for the couple's daughter.

Sullivan, 43, has already agreed to sell his $11 million mansion in Boca Raton, Fla. -- a lavish Mediterranean-style estate with 10 bedrooms and seven fireplaces -- and turn the money over to former WorldCom investors.

qg says... beam me up scotty, it's bernie, we gotta go before we end up sharing a cell with BuD and BuBBA.

updated 7/31/05

14e) Conviction of ex-WorldCom CEO ebbers upheld

A federal appeals court on Friday upheld the conviction of ex-WorldCom Inc. Chief Executive bernard ebbers on charges related accounting fraud, according to media reports Friday. Ebbers was convicted last year of conspiracy, securities fraud and other crimes related to the accounting fraud that led to WorldCom's collapse, but had appealed the jury's decision.

Friday's ruling by the three-judge panel of the 2nd U.S. Circuit Court of Appeals could clear the way for ebbers to begin serving a 25-year prison sentence

ebbers was convicted in 2005. He had argued on appeal that he had been denied a fair trial and that his lengthy prison sentence was unreasonable. Writing for the court, Judge Ralph K. Winter acknowledged that 25 years is a long sentence for a white collar crime, "longer than the sentences routinely imposed by many states for violent crimes, including murder." But he added that ebbers' actions to hide WorldCom's financial problems were substantial and had cost investors dearly.

"The securities fraud here was not puffery or cheerleading or even a misguided effort to protect the company, its employees, and its shareholders from the capital-impairing effects of what was believed to be a temporary downturn in business," Winter wrote. "The methods used were specifically intended to create a false picture of profitability even for professional analysts that, in ebbers' case, was motivated by his personal financial circumstances."

The three-judge panel also affirmed ebbers's 25-year prison sentence, one of the stiffest penalties for a former chief executive in a string of white-collar convictions. The judges called the sentence "harsh but not unreasonable." Under federal rules, inmates must serve at least 85 percent of their sentence -- making Ebbers eligible for release after two decades.

ebbers, 64, has been free on bail pending the results of his appeal. He still can ask the full appeals court to hear his case. But legal experts said ebbers could be ordered to report to prison soon, once judges and the Bureau of Prisons set a surrender date.

15) IBM hires 14,000 in india, cuts 13,000 in Euro/US IBM: news, chart, profile) , already in the process of cutting between 10,000 and 13,000 jobs in the U.S. and Europe, is beefing up in presence in developing markets. The company said sales in India grew 45% in 2004, and it employed about 23,000 there at the end of the year. IBM also has five software development centers in the country.

qualityg says... another major company in a long chain, a loooong chain of "FOOLS." qualityg is not upset about hiring 14,000 in India. qualityg is tired of company's like IBM whose mission is to play hop scotch, instead of increasing market share and ADDING JOBS!!!

Below is the chain you should be following: I will say it again, where have all the leader's gone who knew that the way to win in a competitive global marketplace is by expanding the market and create jobs, not just market share in one place and dispose of jobs in the others.

click to enlarge picture (if not clear, send me an Email & I will be glad to send you a copy).

updated 8/8/05

16) Here Ye, Here Ye, Youth Baseball Coach is 1st Fool inducted into qg Hall of Shame!

A youth baseball coach Mark R. Downs Jr on Thursday was ordered to stand trial for allegedly promising to pay one of his players $25 to hurt a 9-year-old mentally disabled teammate.

A youth baseball coach Mark R. Downs Jr on Thursday was ordered to stand trial for allegedly promising to pay one of his players $25 to hurt a 9-year-old mentally disabled teammate.

Eight-year-old Keith Reese testified at a preliminary hearing that T-ball coach Mark R. Downs Jr. made the offer before a June 27 playoff game.

"He told me if I would hit (the teammate) in the face, he would pay me $25," Keith said.

Reese said he had never before warmed up for a game with his mentally disabled teammate, Harry Bowers. But on that day, he did.

His first toss hit Bowers in the groin area. As the boy walked away, he said his coach told him to "go out there and hit him harder."

"So I went out and hit him in the ear," Reese said.

Downs also belongs in the Absolute Power - Bully category.

qualityg says... Marky boy you should have watched more prison movies, because when you get there, well bring your lipstick.

updated 8/13/05

17) Ford "escorts" salaried employees out the door

Struggling automaker using new "COWARDLY" tactic to slash its payroll

Ford Motor Co., for the first time in generations, has resorted to firing employees and immediately escorting them from corporate buildings -- roiling the company and compelling Chief Executive Officer Bill Ford to send a message this week to reassure the so-called Ford Family.

"Some have asked me why we have had to ask employees to depart immediately," he wrote. "Well, the management team has discussed this and concluded that it's kinder to make our separations in this fashion, rather than have the employee remain in a difficult situation. Frankly, there's no easy way to do this."

qg says... this is hard, qualityg really likes Bill Ford. This is not a new tactic, it's an old "punk" tactic that treats employees like cattle with mad cow disease.

The first time I saw this tactic at my company (also Detroit Michigan) was in 1988. One of my co-workers was breaking down at her desk as a HR person and a security guard stood over holding boxes for her to pack personal goods. Her "sissy" boss wouldn't even come by and say good bye. When I walked over to say a few words and hekp her back I was told by the guard to stand back and go back to my desk. Others had now gathered, I basically said " Buddy, I don't think you want to stand here and tell me that when you only make $6.25 an hour. Over the years tactics got worse, calling people into a fake meeting and telling them they lost their jobs. Someday, I'll write more on this subject.

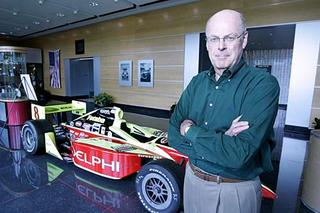

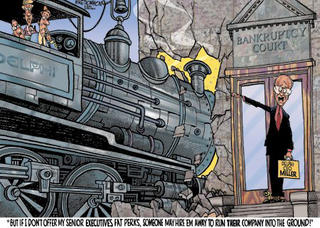

There is a new Oracle of Delphi, Pythia is out and Steve Miller (no not the rock star) is in as the new sage of destruction.

When Delphi CEO Robert S. "Steve" Miller was running Bethlehem Steel, he moved the payment of pension benefits for 95,000 employees to the federal agency.

"It's freeze time, boys." With those words 25 years ago, Chrysler Corp. Chairman Lee A. Iacocca put the United Auto Workers on notice that he would bankrupt the company if union workers didn't agree to concessions. Stevie resigned in 1992. He didn't need a job -- Chrysler had made him quite wealthy.

Standing near Iacocca at that news conference was an eager young finance guy who had ditched a fast-track career at Co. to join Iacocca's Chrysler rescue effort.

In recent days that same executive -- Robert S. "Steve" Miller -- has been saying substantially the same thing to another group of UAW workers -- this time with an even more painful result. The pitiless economics of global competition will force pay and benefit cuts for Delphi Corp workers, just as it certainly did during Chrysler's brush with bankruptcy in 1979-80.

"What (Delphi's Chairman) Steve Miller has essentially asked to do is shred 40 years of gains and renege on the promises the company made to its workers," said Harley Shaiken, professor of labor relations at the University of California-Berkeley. "They may go for even more draconian measures before a bankruptcy judge."

DELPHI'S PAY DEMANDS

Delphi has threatened to declare bankruptcy unless it gets concessions from the UAW and aid from former parent General Motors Corp. The demands, according to newsletters sent to UAW locals, include:

•Reducing pay by as much as 63% to $10 to $12 an hour and total wages and benefits by as much as 77% to $16 to $18 an hour. Delphi currently pays its union workers from $25 to $27 an hour and total wages and benefits of $65 to $70 an hour, making its employees among the best-paid industrial workers in America.

•The right to close, sell or consolidate most of its U.S. plants over the next three years.

•Ending all cost-of-living pay increases.

•Eliminating pay during the Independence week shutdown in July.

•Eliminating the jobs bank, under which Delphi guarantees the pay and benefits for unnecessary workers.

•Reducing holidays to 10 to 12 days per year, down from about 16.

•Reducing vacation to a maximum of four weeks per year.

•Increasing employee contributions for health care to match the salaried plan by increasing doctor and prescription co-pays and other measures. Delphi hourly employees pay about 7% of their health care costs, compared with the 27% paid by salaried workers.

•Changing pensions to reflect the lower wage rates by cutting them to less than $1,500 a month instead of the current rate of about $3,000.

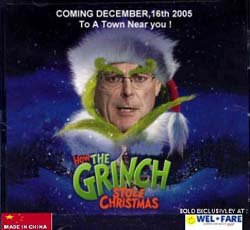

Miller has given the UAW until December 16th, 2005 to respond to Delphi's demands.

YOU ARE A MEAN ONE MR. MILLER

YOU ARE A MEAN ONE MR. MILLER Jingle raps Delphi pay

At a rally in Flint to protest proposed severance packages for executives, Delphi Corp. workers came up with a holiday jingle to the tune of "Jingle Bells":

Dashing to New York

With a briefcase in our hand

Using the press to spread

Our story throughout the land,

We have to close our plants

And let our people go

And find us a Republican judge

Who'll give us all the dough.

Oh, bankruptcy, bankruptcy, it's the American way.

We make a dash and steal the cash

And then we move away, hey.

Overseas, it's just great.

The workers get no pay.

Oh, what fun it is to live in a Republican USA.

Severance packages for Delphi's white-collar employees were capped at 12 months of pay. But in a report to the federal agency that supervises publicly traded companies, Delphi said the top executives are now eligible for up to 18 months of pay and some of their regular bonus.

stevie miller stated "Paying $65 for someone mowing the lawn at one of our plants is just not going to cut it anywhere in industrial America for very long."

miller also offered golden parachutes to 21 top executives days before the bankruptcy filing, a move stevie says is necessary to retaing critical key management during a difficult period.

In addition, the company plans to spend $90 million on bonuses for USA based executives ranging from 30% to 250% of their base salaries.

By: Mike Thompson - The Detroit Free Press

By: Mike Thompson - The Detroit Free Press

That change does not apply to robert s. (steve) miller, Delphi's chairman and chief executive, who works under an exclusive contract -- $1.5 million a year and a $3-million signing bonus -- he negotiated before joining the company earlier this year. But the changes were a result of a review of Delphi's compensation and benefit programs miller initiated.

qualityg says ... 3000 years ago people came from all over Greece and beyond to have their questions about the future answered by the Pythia, the priestess of Apollo. And her answers, usually cryptic, could determine the course of everything from when a farmer planted his seedlings, to when an empire declared war.

Today, Pythia's Oracle is for arrogant greedy CEOs.

The most famous example of this comes down to us through a Delphic prediction given to Croesus, king of Lydia. In 550 BCE, Croesus was preparing to invade the Persian Empire when he consulted the Oracle about his chances for victory. After sacrificing 300 head of cattle to Apollo, he had gold and silver melted down into 117 bricks, which were sent to Delphi, along with jewels, statues, and a gold bowl weighing a quarter of a ton. With these gifts, Croesus sent his question of whether he should attack Persia. The Pythia answered that, if he crossed a river, "Croesus will destroy a great empire." Encouraged by this response, he invaded Persia, only to suffer a decisive defeat. The Persians invaded and then conquered Lydia and captured Croesus, who thereafter bitterly denounced the Oracle. He sent his iron chains to Delphi with the question, "Why did you lie to me?" The Pythia correctly answered that her prophecy had been fulfilled. Croesus had destroyed a great empire -- his own.

American CEOs who want to conquer the global market with your greed? You are destroying our home!

Advice to Ron Gettelfinger - Begore negotiaiting and talking with miiler, remove the emotions from your comments and thinking, he is the idiot, do not lose sight of your objective, he wants you to, he wants to control you and the UAW. You know the system, work within the system, remove the out-of-control-point.

This Greek Tragedy is over and it was predicted years ago by Rock Star Steve Miller who said in his song:

"Go on take the money and run Go on take the money and run Go on take the money and run Go on take the money and run - Delphi CEO stevie miller - YOU PUNK"

UPDATED 10/30/05

Delphi CEO confident that agreement with unions can be reached

Miller says he didn't intend to provoke strike, but realizes workers are angry

"They're very angry with me. You ought to see the e-mails I get ripping my hide," Miller said.

He said "not all my plants are going to survive this," but no decisions have been made on any of the facilities.

qualityg says... " not all my plants..." your plants?? your pension, your people, your compnay, your nothing but another arrogant, insecure CEO that is transforming our economy to third world status.

This was in the Detroit News Editorial on Saturday (10/29/05) :

Daily bee

Memo to Delphi Corp. CEO Robert S. "Steve" Miller: Don't back down. Detroit business leaders rarely tell it like it is, particularly when it comes to unions. Miller has, but now he's said to be reconsidering his honesty. One has to wonder who got in his ear about the tough talking. Make no mistake, the truth hurts but Miller should continue telling it.

qialityg says ... looks like steve will have another job at the Detroit News when he is done gutting Delphi. The Paper Union should beware...

DETROIT - "This is a union town; if they break us here, they'll go after us everywhere," declared Bob Wiland, one of the 2,500 members of six unions that struck this city's two daily papers, the Detroit Free Press and the Detroit News, on July 13, 1995.

Solidarity with the strike is quickly showing itself. Reports from worksites across southeast Michigan indicate wide backing for the strikers, as workers refuse to read the scab paper and campaign to keep it out of their plants.

By what method do you have the right to say he is right? Show me your data and information? You have no idea what you are talking about, except about honesty in words and reporting. God, you arrogant SOBs make me sick!

p/s qualityg has no affilaition with the newspaper, management or unions that are part of the story.

update 11/5/05

Bankruptcy Judge Robert Drain approves paying execs millions if they leave

Delphi Corp., the nation's largest manufacturer ever to file for bankruptcy, won approval Friday from a bankruptcy judge to offer sweetened severance packages to 21 top executives and to pay a law firm more than $800 an hour.

But Delphi executives can't qualify for that benefit without signing an agreement that forbids them from immediately jumping to a competitor -- a requirement designed to keep them from leaving.

qualityg says ... Let them go, Delphi will save in the long run when they go to competitors and screw up those companies.

Please define " Immediately"?

Update 12/12/05

Delphi independent directors to be paid in cash

Bankrupt auto parts maker Delphi Corp. (DPHIQ.PK: Quote, Profile, Research) said on Friday that payments to nonemployee directors will be in cash instead of company stock starting with the next quarterly payment due at the end of 2005.

The committee made the decision after considering the bankruptcy filing in October, the delisting of its stock by the New York Stock Exchange and the need to recruit and retain directors for the restructuring, Delphi said. The lead nonemployee director, John Opie, has volunteered to cut his annual pay to $200,000 from $300,000 effective Jan. 1, while the compensation for other nonemployee directors remains unchanged, Delphi said.

qualityg says... can anyone say Kmart?

update 2/11/06 - go to qualityg wacko week 2/11/06

Update 11/18/05

19)

Conrad Black: Lager-heir to London lord & 3 Other Hollinger Int'l Executives Are Charged with Fraud

He was born conrad moffat black on August 25, 1944, in Montreal. His father, George Black, was a wealthy brewery executive.

Black became known for taking over newspapers and chopping away the fat (and much of the meat as well), resulting in job losses. Criticism aside, these newspapers often turned a profit within a year. So large was his appetite for newspapers that at one point, he was the third-largest newspaper publisher in the world. At its peak in 1999, Hollinger had revenues over $2 billion.

All the money and fame (or infamy) that came with this empire was not quite enough for Black – he wanted a title to go along with it.

An arrest warrant was issued for the 61-year-old Black, a former Canadian citizen who is now a member of the British House of Lords.

Fitzgerald said that if he fails to appear before Judge Amy St. Eve to answer the charges the government will seek to have him extradited.

The indictment said he used a similar bogus agreement to siphon $51.8 million out of Hollinger International's multi-billion-dollar sale of assets in 2000 to CanWestGlobal Communications Corp.

"conrad black asserts his innocence without qualification with respect to each and every one of the charges set forth in the indictment," Connies lawyer said. "It will be shown that he has, at all times, acted within the law (qualityg wants to know whose law? His?)

"For years, conrad black lived large on millions of shareholder dollars -- a federal grand jury has returned an indictment that says he did so by means of criminal fraud."

qualityg says... no more Black Label Beer. This FOOL at one time tried to advocate that Canada become part of the United States. I guess he wanted to hang out more with the other fools listed in this blog. Perhaps cell mates will do!

Updated 12/16/05

19a) connie black Pleads Not Guilty to New Charges

Former newspaper tycoon connie black pleaded not guilty to new charges of racketeering, obstruction of justice, money laundering and wire fraud in the alleged plundering of $80 million from Hollinger International Inc.

Among the latest charges Lady connie was accused of violating court orders in May by carrying boxes filled with documents out the back door of his Toronto offices after hours, after a Canadian court official had already tried to stop him.

20) Khodorkovsky to Serve Jail Term in Siberia - Hey can we send you some American CEO --> Comrades?

qualityg says... This post is not so much about Mikhail Khodorkovsky as it is where he is serving his time and what he is doing. If you are not familiar with him he was Russia's richest man (Yuros Oil) and is now serving six years in a prison far far away somewhere in the North East that is considered to be contaminated with Uranium (I suppose it saves on lights at night, I heard they made "Glow Worms"). To keep tabs on this comrade http://www.mbktrial.com/media/20051127-1204.cfm

It is reported that MK is sharing space with crime bosses. Lush prison jobs include cleaning pigsties and sewing (keeps up the fine and gross motor skills).

I often read that prison over crowding is a problem in the United States. I think I found the solution. Russia needs money and we can give them all the comrades listed in this post.

Comrade Ebers sounds good - Instead of "Club Fed" we can call it "Club FOOLS"

21) Former Qwest CEO Joseph Nacchio (aka Johnny Quest) Indicted on 42 Counts of Insider Trading

"I want to build a company that basically sets the rules to how this industry works in the 21st century in the United States and has a strong influence globally." - Joseph Nacchio

A federal grand jury indicted former Qwest Communications Chief Executive Joseph Nacchio Tuesday on 42 counts of insider trading accusing him of illegally selling $101 million in company shares after privately learning that Qwest might not meet its financial goals.

The indictment accuses Nacchio of selling $101 million worth of company stock in the first five months of 2001 when he allegedly had insider information. The sales took place in 42 transactions ranging from $191,000 to $13.6 million each.

Nacchio began his AT&T career in 1970 as an engineering supervisor. He worked his way through the ranks and different departments and was named president of the Consumer Communications Services in 1993.

I met Nacchio in 1995 at the Malcolm Baldrige National Quality Award where AT&T Consumer Communications Services won in the award. In the mid 90’s AT&T ruled the Quality Awards (two Baldriges and the most prestigious of all The Deming Prize from Japan.

In both a formal setting and informal setting Nacchio was always the center of attraction. A very articulate, dashing and charismatic speaker it was hard not to like the guy. However, the person who came across as the best representative in terms of quality knowledge and representing his company was Vice President and General Manager Frank Ianna. When Nacchio was in a forum with other AT&T employees he was quick to answer first and to answer last always leaving the audience that he was in control. His main goal was always to be named CEO of AT&T.

The indictment is part of a wave of government prosecutions of executive’s accused of improperly burnishing their companies' results to attract investors near the climax of the stock-market boom of the 1990s. Former WorldCom Inc. CEO Bernard Ebbers was sentenced to 25 years in prison in July for leading the largest fraud in U.S. history. The trial of former Enron Corp. CEOs Kenneth Lay and Jeffrey Skilling is set to start next month.

So what now Johnny Quest, you better call in the team to rescue your butt. Do they allow hairpieces in prison?

update 12/29/05

FORMER QWEST RATS (I mean execs) PLEADING GUILTY

Former Qwest Communications (Q) executive tom hall, who was scheduled to go on trial next month on charges stemming from an accounting scandal, will plead guilty.

Hall, a former senior vice president at the Denver-based regional telephone company, was the last of four former Qwest managers still to go on trial for conspiring to illegally boost Qwest revenues.

weisberg, a former senior vice president who oversaw investments, mergers and acquisitions for Denver-based Qwest Communications International Inc., pleaded guilty to a single count of fraud. He had faced eight counts of wire fraud and three counts of money laundering.

Update 1/3/06

22) PricewaterhouseCoopers Global Economic Crime "FOOLS" Survey 2005

When caught, most of the "FOOLS" claimed that they were unaware that the were doing anything wrong and that they were driven to commit their fraud in order to maintain an expensive lifestyle.

45% of companies reported falling victim to fraud in the past two years

On average they recorded suffering an average of 8 serious incidents

Since 2003 there has been:

a 71% increase in the number of companies reporting cases of corruption & bribery

a 133% increase in the number reporting money laundering; and

a 140% increase in the number reporting financial misrepresentation

Fraud that led to a loss of assets cost companies—on average—over US$ 1.7 million: a 50% increase over 2003

40% of suffered significant loss of reputation, decreased staff motivation, and damaged business relations

Over one third of these frauds were discovered by accident, making "chance" the most common fraud detection tool. Internal and external tip-offs and other accidental means accounted for 34% of the corporate scandals covered by the survey.

qualityg says ... we need a new "Reality Show" with undercover management whisleblowers exposing crime in Corporate America - Let's call it "FOOLS FOR A DAY"

Updated 3/15/06

davED's Bio says : edmondson graduated from Pacific Coast Baptist College in San Dimas, California, where he earned degrees in theology and psychology.

davED's Bio says : edmondson graduated from Pacific Coast Baptist College in San Dimas, California, where he earned degrees in theology and psychology.Company officials have said when Mr. Ed was hired, the company didn't verify his academic credentials.

They basically assumed they were correct.

Mr. Ed was given a severance package of less than $1.35 million in cash.

qualityg says ...

Ah Wiiiiilbuuuur, I didn't mean it!

Ah Wiiiiilbuuuur, I didn't mean it! update 4/9/06

Are you for real? Absolute Power at its Worst.

I hear they call you the Hammer? The Hammer drops out: Facing eroding support in his home Congressional district and entrenched in a series of ethics scandals, Tom DeLay announced today that he will resign from Congress in May or June. Tom DeLay may be leaving Congress, but the culture of corruption he helped build remains.

If I had a hammer

If I had a hammer

I'd hammer in the morning

I'd hammer in the evening

All over this land

I'd hammer out danger

I'd hammer out a warning

I'd hammer out love between my brothers and my sisters

All over this land

Have fun at Art Van Delay Industries!

25) Lay, Skilling Convicted in Enron Collapse

qualityg has been waiting for these two rascals to get their just dues:

Enron Corp. -- Enron founder kenneth lay, former CEO jeffrey skilling and former top accountant richard causey are scheduled to go to trial in January on federal fraud and conspiracy charges.

12/27/05 - Enron's former accounting chief, richard "I want my Mommy" causey, has agreed to plead guilty and testify against his former bosses in exchange for a chance at a lighter prison sentence. causey had been scheduled to go on trial next month for conspiracy and fraud alongside the bankrupt energy-trading company's former chairman, kenneth lay, and chief executive, jeffrey skilling. "This is not what skilling and lay were hoping for on the eve of the trial," said one legal expert. A lawyer for skilling said the defense would have to "substantially regroup."

12/29/05 - Prosecutors with the Enron Task Force scored a coup Friday when ken rice, former CEO of the company's broadband unit, pleaded guilty to one count of securities fraud and agreed to cooperate with their investigation. The guilty plea, which carries a maximum sentence of 10 years, gives prosecutors a significant witness against jeff silling, Enron's former chief executive officer.

05/25/06 - Kenneth Lay and Jeffrey Skilling were convicted of conspiracy and fraud Thursday by a federal jury that laid blame for one of the biggest business scandals in U.S. history squarely on Enron Corp.'s two former top executives.

Jurors found that the once-wealthy and powerful corporate chiefs repeatedly lied to cover up accounting tricks and business failures that led to its 2001 demise. The collapse wiped out more than $60 billion in market value, almost $2.1 billion in pension plans and 5,600 jobs.

"Obviously, I'm disappointed," Skilling told reporters outside the courthouse. "But that's the way the system works."

"Obviously, I'm disappointed," Skilling told reporters outside the courthouse. "But that's the way the system works."

"I firmly believe I'm innocent of the charges against me," Lay said following the hearing. "We believe that God in fact is in control and indeed he does work all things for good for those who love the lord."

qualityg says ... The workers say it best ...

Ex-Enron workers rejoice after verdicts

Former employees say the jury did the right thing in convicting Ken Lay and Jeff Skilling.

Ex-Enron employees: Give 'em 'hard time' - "Skilling and Lay don't know what it's like to go get food stamps and welfare while looking for employment full time," said an ex-employee. "It's awful. Can I send my rent bills to Mr. Lay and Mr. Skilling?"

Leave it to a Texan, Nick Anderson(www.chron.com/nick) from the Houston Chronicle to draw a great picture.

Update 10/23/06

Skilling Sentenced to 24 Years in Prison

U.S. District Judge Sim Lake sentenced Former Enron CEO Jeffrey Skilling was ordered Monday to serve 24 years and four months in prison, the harshest punishment by far in Enron's scandalous collapse and one that capped a string of tough sentences for top executives in corruption cases.

His crimes have imposed on hundreds if not thousands a life sentence of poverty," Judge Lake said.

Skilling's arrogance, belligerence and lack of contriteness under questioning made him a lightning rod for the rage generated after Enron sought bankruptcy protection in 2001.

qualityg says ... Look at it this way Jerry, you lost again, bernie boy from WorldCom got 25 years.